The peer to peer lending industry in India has grown comparatively slowly than other nations across the globe. In a country of over 1.2 Billion people, the opportunity for online lenders to provide a much-needed service to a significant underbanked population has not been missed by entrepreneurs and I2Ifunding has evolved as an integral platform for it.

For those who don’t have much idea about Peer to Peer lending, it is also named with P2P lending and it is the practice of lending money to individuals or businesses through online services that match lenders directly with borrowers.

As P2P lending companies offer service mostly online and so less overhead needed and are the reason these are cheap compared to similar offline services.

Many entrepreneurs have come up with a solution to aggregate the P2P lending services on a common platform to serve better and I2IFunding is one of the leading platforms for the P2P services.

Here in this article I am going to review I2Ifunding and will show you how I2Ifunding is helping the individuals and companies to deal with money so easily. So let’s start with I2IFunding Review.

Contents

I2IFunding Review

I2ifunding is a Leading Peer to Peer Lending Platform in India. It connects the lenders to the investors more effectively compared to the other financial institutions.

P2P Lending provides alternative investment option to Investors and affordable P2P loans to Borrowers.

The borrowers can get a personal loan starting at just 12% and investors can expect a return up to 30% with principal protection.

I2IFunding was started back in 2014 with five co-founders with an aim to make the lending and investing work easy for Indians. It is not just another P2P marketplace but also provides providing end to end loan servicing, i2i diligently evaluates the credit risk of each of the loan projects, a post which it assigns risk category and recommends an interest rate for that project.

I2i is all set to change the way in which financial transactions are being currently carried out. This is being done by saving the costs from the offline office, the most human force required for offline activities etc. in traditional ways of lending.

How I2IFunding Works?

As we know at I2I platform, an individual can borrow money at the desired rate of interest and an investor can lend to retail borrowers at interest rates up to 30% and for the FIRST TIME get an opportunity to earn high returns, earlier available to banks, NBFCs etc.

I2I is helping in ways to make the entire process smoother and easy for both lender and investor.

The above image depicts the complete working of the P2P platform with the involvement of both investor and borrower.

Below are some of the basic steps to start with I2IFunding-

• Register at i2i: To participate in any transaction, first you will have to register at I2I. It is free and no upfront being charged. Just you will have to fill the demographic details and approve your account. Once approved, you will be assigned a relationship manager who will be your point of contact further.

Now depending on your role (Lender/investor), you will have to proceed further.

For Borrower

If you are a borrower, you will have to follow the below steps. You can also check the official I2I page as for how it works.

• Create a Borrower Account: Create a separate account for borrower

• Interest Rate for Borrowers: The platform will help you to set the lowest rate with investors.

• Post the Loan: A borrower can post the loan at an interest rate higher than or equal to the i2i Recommended Interest Rate.

• Borrower – Receive Funds: After the verification and contract, the loan will get funded.

• Repayment of EMIs and Loan Closure Certificate: A complete repayment schedule will be provided to the borrower.

For Investors

Below are the steps those involve in the entire process if you are an investor.

• Create Investor Account: Create a separate account for investor

• Investor’s Wallet: After profile, your wallet will be created which will have your profile ready

• Invest in a Loan: An investor can commit to lend a single or multiple borrowers.

• Investor – Transfer of Finances: Once the loan is completed, documents will be returned.

• Receive Monthly Payments: An investor can utilize the repayment amount as per his / her wish.

Borrower

You can browse through the borrower page and calculate the monthly installment and total saving you will have.

You can take the loans for any occasions like home renovations, medical issue etc.

Investor

No matter how much you want to invest, I2I is a perfect platform for you where investment starts with just INR 5000.

They have categorized the investors in the different categories and based on it, the company provides % Protection.

| Risk Category | % Protection |

| A | 100% |

| B | 90% |

| C | 80% |

| D | 70% |

| E | 60% |

| F | 50%; |

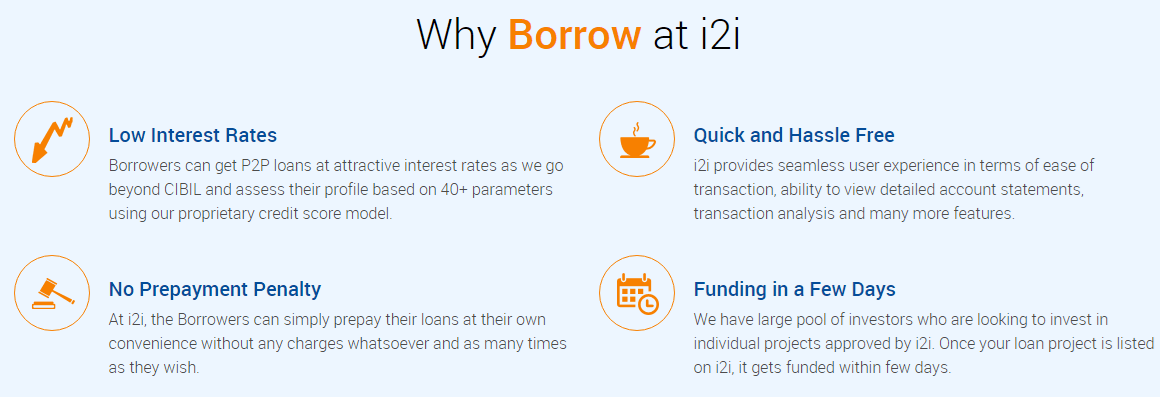

Why should one borrow at I2I?

There are various reasons to borrow from I2I apart from the fact that it is the free and most reliable source.

What do others say about I2IFunding?

Here are some of the feedback shared by the existing borrowers and investors-

Conclusion

This was all about I2IFunding Review. I2I is an awesome platform for all kind of P2P transfers. Borrowers can get easy loan and investors can invest their hard earned money and can earn big.

Do share your experience with us if you have ever used the I2I platform.